As ageing marina infrastructure from the 1970s and 1980s reaches the end of its 30-year design life, the global marina sector is confronting a pivotal moment that demands significant reinvestment. From the rise of larger, more power-hungry vessels to stricter environmental regulations and congested coastlines, operators and suppliers are innovating fast. At Metstrade industry experts sat down with MIN to outline how sustainability, smarter engineering, and geographic expansion — particularly into high-growth regions like the Red Sea — are reshaping the marina business landscape.

“We’re quite a robust industry,” says Barnaby Hayward – at Metstrade as Marina UK and the Boat Lift representative (UK and Ireland) – an Italian company specialising in boat lifting and handling equipment based in Alba, near Turin.

He attended ICOMIA’s recent marina conference and says it showcased the industry as collaborative and sharing ideas between everybody as opposed to seeing each other as competitors. “We all come together as an industry, sharing global trends and what the customer’s expectation is.” Taking ideas back to each operation makes it more sustainable for the future.

Hayward says Boat Lift’s customers are demanding sustainability – because their customers are demanding it. “The end customer’s expectation is is far greater than what we think sometimes . . . marinas want to do it for the environment but then their customers would like to keep their boat in, and be proud of keeping their boat in, an environment and in a marina that takes sustainability seriously.”

He’s now eyeing opportunities in that sustainable space. “The pelican lift doesn’t require the need for a lifting pool, so therefore you’re not intrusive on the seabed with the pilings themselves.” He says that many marina operators are finding the planning permissions challenging (putting pilings and buildings into the sea) so this patented product helps overcomes that. More details about the pelican lift can be found on the company’s website.

If you can’t go out, go up

Ricardo Coutinho from Nautisys – a Portuguese company that provides dry-stack solutions for boat storage – says his company is implementing a new system for boats as “the marinas are full, at least for now.”

His solution offers a crane that takes boats directly from the water and places boats upto 10 metres into dry storage – the crane is inbuilt and moves back and forwards through the 12-16 meters high stack. The process is shown on the company’s website.

“It’s about the structure,” he says. “If we need to make for bigger boats on height, it’s not so sustainable — we need a very big structure. We prefer to use for the smaller boats.”

Nautisys’ very new, it’s been in operation for two years.

Introducing a new system in Europe has been hard, Coutinho says, because while the system is used in the United States, Europe has yet to adapt to the idea. Nautisys hopes to make its first crane installation in Spain or Portugal in 2026, it built more traditional rack systems for two installations last year.

Emerging marina investment trends driven by ageing infrastructure

Telemetra offers waterproof marina pedestal solutions to replace old electronics in existing marina pedestals. The company’s looking to expand into the European market with what it calls its affordable and sustainable upgrades.

Marco Penzo, representing Telemetra and pictured, says the next challenge to face marinas is that new boats require much more power. “Ten years ago, a boat had a battery and freezer. Nowadays, almost every boat has an air conditioning system, one, two, or three freezers, many electrical winches.”

In the past, marinas projected that one socket would service one boat. That’s no longer enough as boat’s now require two, he says.

“And every year, the energy increases. So it’s a big challenge for marina to give this service to the customer. Also the boats are becoming bigger, is an increasing market.”

In the past 12 months, the company started partnerships with Turkish and Greek representatives, and appointed an experienced manager in Italy. It’s now looking to expand use of its ‘totally waterproof device’ rapidly.

“Replacing an old pedestal is an expensive and huge project. Refitting is easier sometimes. If you have old pedestal, you remove the old electronics and place the new ones in the same pedestal, it’s cheaper and very easy.” This is then linked to a smartphone app, eliminating the need for displays exposed to sun damage.

How larger vessels are re-shaping marina investment trends globally

Inland Coastal and Marina Systems works in both the leisure marine and commercial sector and specialises in marina infrastructure. Currently it’s heavily commercial-biased in the UK while in Ireland – where the company is headquartered – the balance is different.

Similar to Penzo’s comments about larger vessels, ICMS is facing this in the offshore wind sector. Bryan Stewart (pictured) says the company’s currently working on a project in Grimsby to make “heavier and heavier duty pontoons and berthing.”

Logistics is always a challenge for the company. “It’s getting harder and harder to move big items around the place, and more expensive, and all our stuff is big and heavy. We’re putting more time and energy in to try and resolve it . . . It’s something we need to get better at.” This means the company’s investing both time and resource to looking at different options, including moving product around by water rather than by road. In 2019, ICMS released a video showing the intricacies of transporting massive concrete blocks through small Irish towns.

That may become even more important as there could be a huge uptick in marinas looking at their infrastructure. Product that’s coming to end of life is a looming challenge for marinas.

“There was a lot of investment in marine space in the 70s and 80s, and a lot of marina infrastructures designed to a 25 or 30 year life cycle, so that creates some challenges. It requires a lot of investment. Some organisations have more appetite and more ability to be able to invest in others.”

ICMS appears to be in a solid position when it comes to supplying the sustainable credentials that Hayward speaks to.

“The science of building greener concrete is evolving all the time. We’re working with partners to put different additives into the mixes that don’t compromise on quality, but improve the environmental impact.” Plus he’s looking at a 50 year design life.

“We’re also working in partnership with a business in Australia called Reef Design Lab to manufacture, sell and licence their Living Seawalls product.” The partnership began in 2023.

Potential for marine companies in the Red Sea

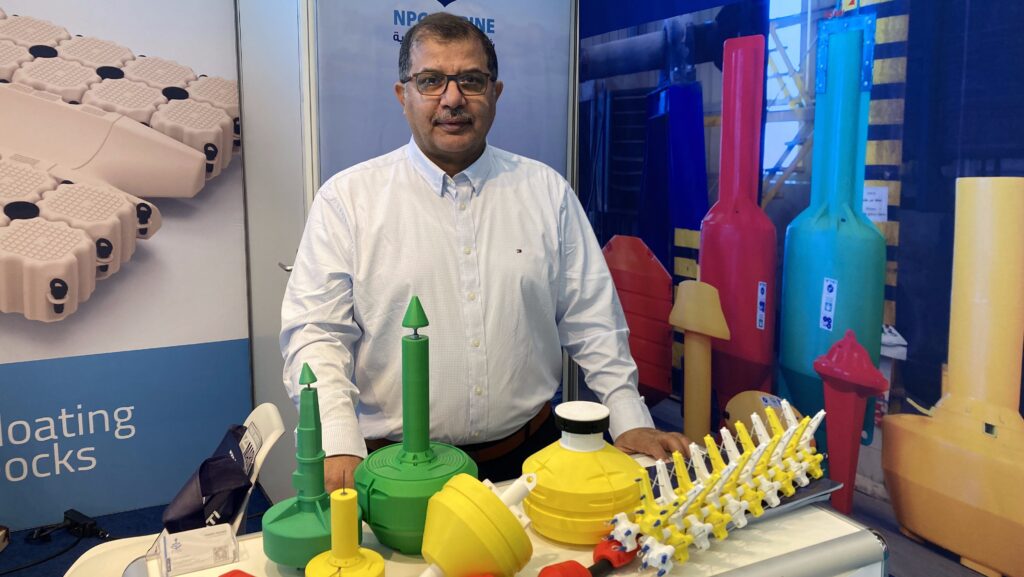

NPC Marine’s got a keen eye on marine developments in the Red Sea.

“The region is developing … more than 50 islands are being developed. The environmental regulations are very strict – all materials used must be environmentally friendly because the Red Sea is 90 per cent virgin, untouched territory,” says Ahmad Abaalkhail. He’s optimistic about the marina business potential in both Saudi Arabia’s west coast (Red Sea) and east coast (between Qatar, Kuwait, and Saudi Arabia) over the next decade.

NPC is a Saudi-based company that has been operating for 26 years – it’s contact details are on LinkedIn. It’s evolved from producing water tanks to expanding into road barriers, animal feeders, gasoline tanks, and marine products. It’s been in the latter sector for six years, initially focusing on floating docks before expanding to plastic buoys, navigation buoys, moorings, and now smart buoys. It works with marinas in the Red Sea, providing customised solutions and floating docks.

Abaalkhail says being a Saudi company gives an advantage in local projects due to ‘Saudi-isation’ policies (which chose local manufacturers over cost). There is plenty of information online about how companies which want to make the most of the Red Sea boom can become Saudi-ized. Abaalkhail says “within five minutes, click, you can initiate your company, but it has to be 50-50 or 40-60 owned with a Saudi company. It’s very simple, very easy.”

Recently NPC Marine’s been developing security barriers – tested with the coast guard and Aramco – to protect projects like water desalination plants against bombing boats from Yemen. Now approximately 12 kilometers of these barriers are in place with another six km expected to be installed in 2026. It’s also developed smart buoys which contain sensors to monitor air quality, sea conditions, and track boats.

Private capital and consolidation shaping US marina investment trends

Tamara Kramer believes that – unlike expectations – covid-buyers aren’t walking away from their recreational investments as much as doom-sayers would have the industry think. She works for Den Hartog Industries, a manufacturer of water-molded, injection-molded, and glow-molded marine dock parts based in Iowa, USA.

The company – which celebrates its 50th anniversary in 2026 – had a slow start to 2025, but that improved as the year progressed – especially within the domestic market.

She says US marinas are concerned about the cost of improvements for the old infrastructure currently in place. Kramer highlights an interesting trend in the US whereby investment companies are buying older marinas from retiring owners and improving their infrastructure. She estimates there are about four major investment companies currently involved in this, making the most of the fact that people still want to ‘recreate’ on the water.

“We’re part of the rebuild, and new build. We have both of those kinds of projects often going on at the same time.”

Expanding into Europe

Amilibia Marinas a Spanish company specialising in marina construction and renovation – is looking to expand its operations across Europe. Like others in the sector, it says ageing infrastructure of many marinas (30-40 years old) requiring renovation, represents a significant business opportunity.

Iñaki Barjacoba (pictured) says the company engineers marinas – the pontoons, and the piling. It designs layouts of the marina, the profiles, the type of floats, the type of pontoons and more. “we can adjust our products to whatever needs.”

Amilibia Marinas is currently trying to open new markets in other countries. “We find it pretty difficult,” Barjacoba says. “They are already settled, they’ve got their own manufacturers and it’s pretty difficult to start in a new country.” He cites France, Italy, Greece, and Croatia as being on the target list, but says that bureaucracy, different legislation and, many times, protectionism gets in the way.

Meanwhile, he says there’s definitely a movement away from reinforced concrete with fixed piles to floating marinas. “It’s a great opportunity.”

Barjacoba adds the company’s aluminium pontoons are recyclable, unlike concrete ones, and that it uses a proprietary composite material for which it holds the copyright, though it currently can only recycle a small percentage of its materials.

The next decade will test the marina sector’s ability to modernise at scale, embrace sustainability as a business imperative, and navigate new regional opportunities while wrestling with ageing assets. Yet across lifting systems, electrical upgrades, floating infrastructure, dry-stack storage and emerging markets, one message is clear: companies that invest early in adaptable, low-impact, future-proof solutions stand to benefit most from the industry’s looming renewal cycle. As global demand for leisure boating holds strong and environmental expectations rise, the marinas that innovate today will define the waterfronts of tomorrow.

The post Global marina infrastructure: investment, innovation and market shifts in a renewal cycle appeared first on Marine Industry News.

Leave a Reply